Why You Need an Emergency Fund (and How to Build One)

Back when I was broke, every emergency felt like a full-blown crisis. Everybody panicked if I cracked a tooth on a Nature Valley bar, if the AC went out mid July, or if my car started making humpback whale sounds. I was in trouble because I had no financial cushion between me and life.

It’s like when you get in trouble in youth group because you failed to “leave room for Jesus.” Traumatic in different ways.

When I decided to get control of my money, one of the first things I did was build an emergency fund for when the unexpected happens.

I get a lot of questions about emergency funds:

- How much should you save?

- Where should you keep it?

- What even qualifies as an emergency?

(Spoiler: the Taylor Swift 1989 re-release on vinyl — not an emergency. But yes, I will still be buying it.)

Murphy’s Law Will Move in With You

You’ve heard of Murphy’s Law , anything that can go wrong will go wrong. But there’s also Murphy’s brother, Cole. Known for… Cole’s Law. (I’m not a fan of either.)

If you don’t have an emergency fund, Murphy will move in full-time, watch Narcos in the back room, and finish your leftover pizza faster than you can say “cauliflower cheese stuffed crust.”

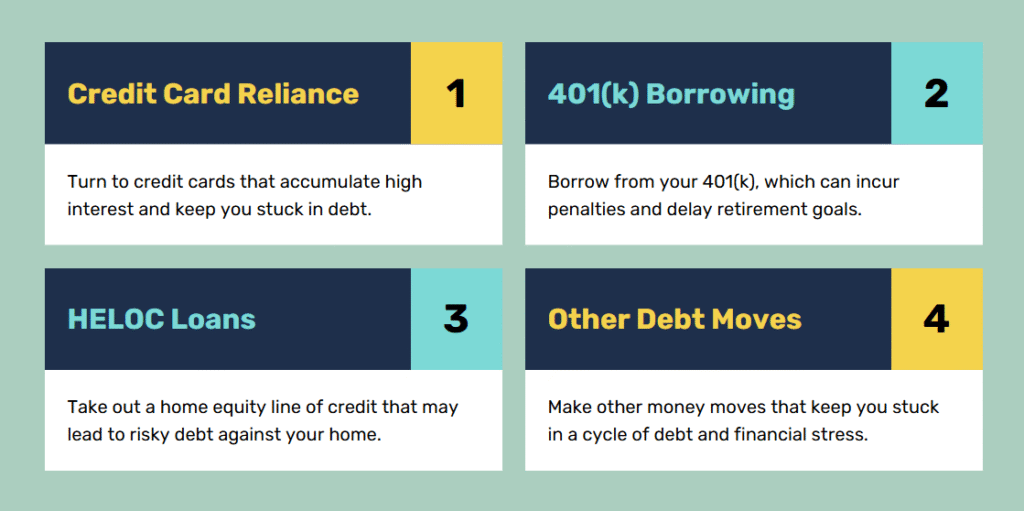

Without an emergency fund, you’re likely to:

- Turn to credit cards

- Borrow from your 401(k)

- Take out a HELOC

- Or make other money moves that keep you stuck in debt

If You Have Debt — Start Small

Before you go building a huge emergency fund, here’s a PSA:

If you have consumer debt, focus on getting out of debt first.

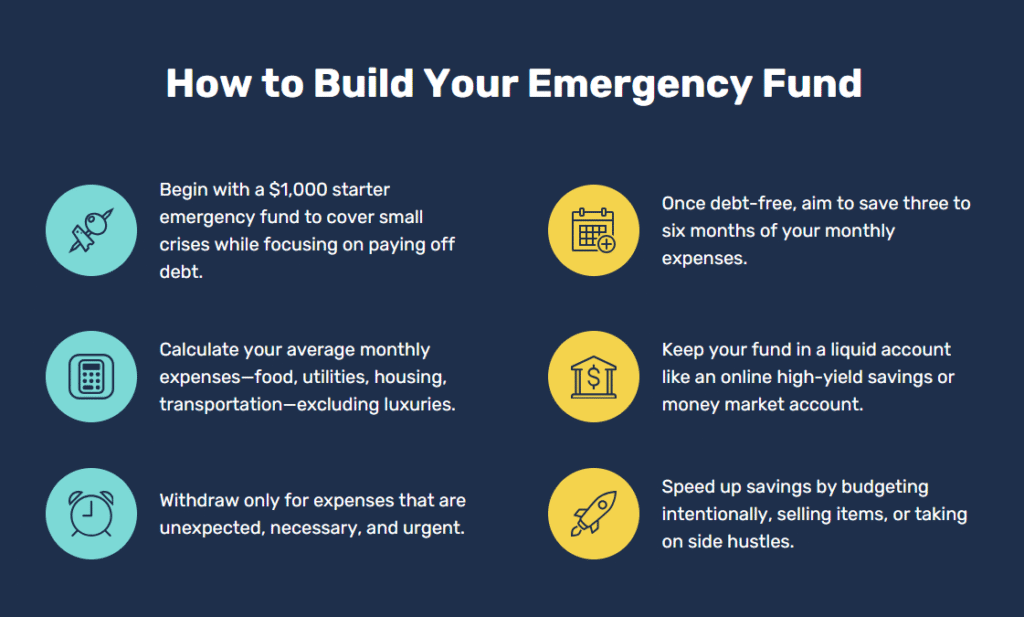

But you should start with a $1,000 starter emergency fund.

If $1,000 feels impossible:

- Be intentional with your budget

- Sell some stuff

- Do a side hustle

- Cancel subscriptions

You can reach $1,000 in less than a month if you focus.

This small fund isn’t meant to cover everything. It’s just enough to keep you afloat while you put your energy into paying off debt.

The Fully Funded Emergency Fund

Once you’re debt-free, it’s time to graduate to a fully funded emergency fund: 3–6 months of expenses saved.

How to calculate:

- Look at your monthly household expenses , food, utilities, housing, transportation.

- Leave out luxuries like Friday nights at Applebee’s or weekly bassoon lessons.

- Multiply your monthly total by 3 or 6.

Example:

If your monthly expenses are $5,000:

- 3 months = $15,000

- 6 months = $30,000

Should You Save 3 or 6 Months?

Save 6 months if:

- You’re married with one income

- You’re a single parent

- You’re self-employed

- You have irregular income (commissions, seasonal jobs)

- You or someone in your household has chronic health issues

Save at least 3 months if:

- You’re single with no dependents and a stable income

- You’re married with two stable incomes

Where to Keep Your Emergency Fund

Bad ideas:

- Under your doormat

- In your glove compartment

- Inside the cookie jar

Better ideas:

- Savings account connected to checking

- Money market account with debit/check access

- Online high-yield savings account (my favorite)

Key: Make sure it’s liquid — easy to get to when you need it. It’s insurance, not an investment.

When to Use Your Emergency Fund

Ask yourself:

- Can I adjust the budget this month instead?

- Is it unexpected?

- Is it necessary?

- Is it urgent?

If all three are yes, it’s a real emergency.

Example of a non-emergency: your friend’s last minute bachelor trip to Pensacola Beach (even if it includes a dolphin cruise).

Building Your Fund Faster

Saving isn’t as exciting as spending, but most people can build their full fund in six months or less. And here’s the funny thing: once you have an emergency fund, “emergencies” often just turn into inconveniences.

Why? Because you’re in a better position to:

- Afford higher quality items

- Keep up with maintenance

- Have financial margin

The Bottom Line

Make your emergency fund a priority. If your fantasy football team matters more to you than financial security, you’ll never have it.

Once you have that extra cushion, you’ll experience a warm, bold flavor of financial peace, hints of freedom, vibrant notes of cash flow, and vacations.

If you don’t have an emergency fund (or it’s too small), start now. Make a budget, find extra money, and keep it liquid. You’ll thank yourself later.