Understanding Investment Risk, A Simple Guide to Building Your Wealth

If you’re going to build wealth by investing, you’re going to need to take some risks. I mean, you literally can’t have one without the other. But risk, when it comes to investments, is notoriously difficult to quantify, and if you’re new, the whole thing can be pretty bewildering. So let me help.

Hi, In this blog I’ll cover three things:

- How I define risk in a way that makes sense and how I talk about it with clients.

- A simple, dead-easy way for you to measure your own risk tolerance.

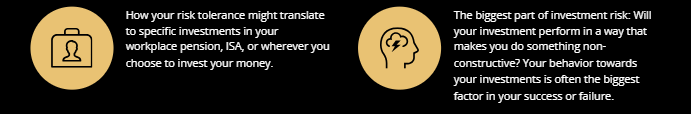

- How that might translate to specific investments in your workplace pension, ISA, or wherever.

What Is Investment Risk?

Risk is multifaceted and somewhat abstract until it happens to you. Most people think of risk as:

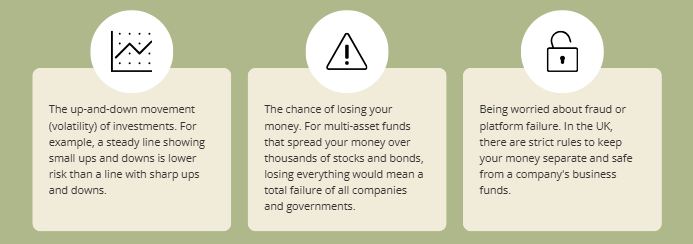

- The up-and-down movement (volatility) of investments. For example, a steady line showing small ups and downs is lower risk than a line with sharp ups and downs. But remember, volatility is just one part of risk.

- The chance of losing your money. For multi-asset funds that spread your money over thousands of stocks and bonds, losing everything would mean a total failure of all companies and governments, which is extremely unlikely.

- Being worried about fraud or platform failure. In the UK, there are strict rules to keep your money separate and safe from a company’s business funds. Even if a platform gets hacked, there’s insurance, so while there might be delays accessing money, your money itself is usually safe.

But for me, the biggest part of investment risk is this: Will your investment perform in a way that makes you do something non-constructive? For example, if your ISA loses value and you panic sell, that’s the real risk.

Your behavior towards your investments is often the biggest factor in your success or failure.

Measuring Your Risk Tolerance

Three things to consider:

- Understanding: Rate your knowledge of investments and economic factors from 1 (none) to 4 (advanced).

- Experience: Rate your personal investing experience from 1 (none) to 4 (many years through different markets).

Add the scores to get a total from 2 to 8, which indicates your risk profile:

- 2-3: Cautious investor

- 4-5: Balanced investor

- 6-7: Growth investor

- 8: Adventurous investor

This is a starting point to build on as your knowledge and experience grow.

Factor in Your Time Scale

How long can you invest without touching the money?

- 1-2 years

- 3-5 years

- 6-10 years

- 11+ years

Longer horizons allow more risk-taking. For example, if you’re a balanced investor with 11+ years, you might tilt more toward growth investments. If your horizon is short, reduce risk, or consider keeping money safe in deposits.

Think of this as “risk flex”, adjusting risk based on time.

Simplifying Risk: Equity Exposure

A simple way to view risk is by the percentage of your portfolio invested in shares (equities):

- Cautious: Up to 40% equities

- Balanced: Up to 60% equities

- Growth: Up to 80% equities

- Adventurous: Up to 100% equities

Remember, these are rough guides, and markets constantly move. For instance, in 2022, cautious investors with heavy bond exposure saw impacts from inflation.

What Next?

Choosing the right fund in your pension or ISA depends on your risk profile and other factors. I’ll cover examples in my next video.

If you have questions, feel free to leave comments. And watch out for scams pretending to be me never chat on WhatsApp for investment advice.

Please follow my blog, if this helps, you’ll see future blogs front and center.

Thanks for watching, and see you next time!