Top 10 Budgeting Tips as a Student

Hello everyone, here we talk all things financial stability, credit scores, budgeting, and self-improvement.

How to Survive Uni Life at Surrey, On a Budget

I’m a final-year student at the University of Surrey, and after years of trial and error, I’ve learned a lot about managing finances as a student. Today I’m sharing everything I’ve learned so you don’t make the same mistakes I did.

💸 My First-Year Financial Fails

Let’s take it back…

- In my first year, I was very irresponsible with money.

- I ordered takeaway almost every day, Deliveroo, Domino’s, you name it.

- I’d do massive food shops at Tesco, store everything in the fridge, and then let it go bad because I was always ordering food.

- Looking back, I’m honestly embarrassed, but I know I’m not the only one who’s done this.

The good news? There are actually a lot of free options and budgeting tricks I wish I knew back then.

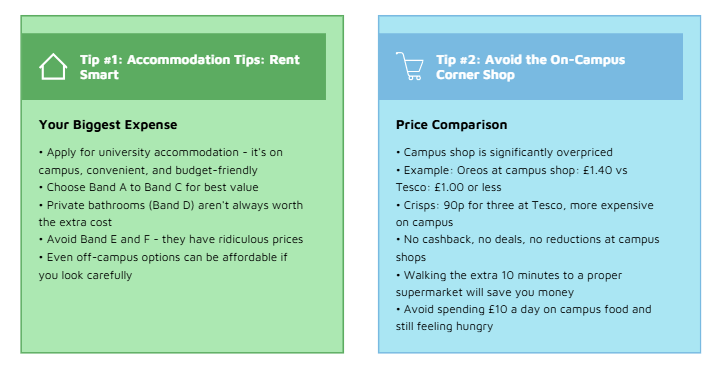

(Tip 1) Accommodation Tips: Rent Smart

Your biggest monthly expense is going to be rent.

My Advice:

- Apply for university accommodation it’s on campus, super convenient, and can be budget-friendly.

- Choose Band A to Band C:

- These are the best value for money.

- Band D gives you a private bathroom, but it’s not always worth the extra cost.

- Band E and F? Ridiculous prices.

Even if you don’t get uni accommodation, don’t worry there are still affordable options off-campus.

(Tip 2) Avoid the On-Campus Corner Shop (Seriously)

Let’s talk about the campus shop… whew.

- It’s overpriced.

- Some staff? Not the friendliest.

- You can literally order takeaway and still spend less.

A Personal Example:

I used to live 45 minutes from campus. I wouldn’t go home for lunch and ended up spending £10 a day on food and still felt hungry.

Real Price Comparison:

- Oreos at campus shop: £1.40

- Oreos at Tesco: £1.00 or less

- Crisps: 90p for three at Tesco, more expensive on campus

- No cashback, no deals, no reductions

Seriously just walk the 10 minutes to Tesco and save your money.

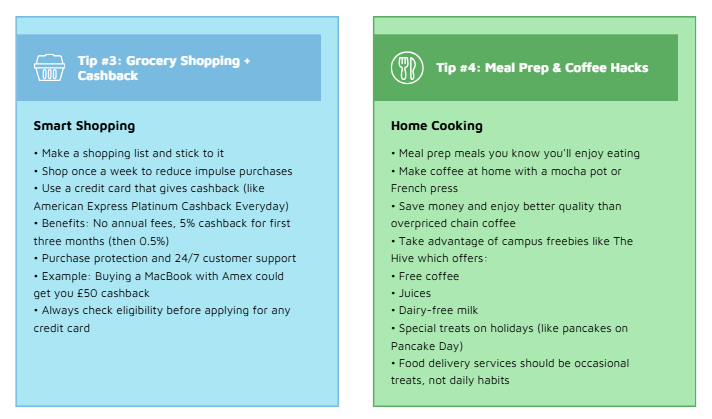

(Tip 3) Grocery Shopping + Cashback = Winning

Pro Budgeting Tip:

- Make a shopping list

- Shop once a week

- Stick to it!

Pay with a Credit Card That Gives You Cashback:

I use the American Express Platinum Cashback Everyday card.

Why I love it:

- No annual fees

- 5% cashback for the first three months (then 0.5%)

- 24/7 customer support

- Purchase protection (lost packages? Amex sorts it out)

- I bought my MacBook using Amex and got £50 cashback

👉 Use the eligibility checker before applying.

(Tip 4) Meal Prep & Coffee Hacks

If you’re ordering delivery twice a day you must be on a wild budget.

Instead:

- Meal prep meals you know you’ll enjoy

- Make coffee at home

- Fancy it up with a mocha pot or French press

- You’ll save money and probably enjoy it more than overpriced Starbucks

Hidden Gem:

- The Hive gives out:

- Free coffee

- Juices

- Dairy-free milk

- Pancakes on Pancake Day

- …and more!

Why isn’t this better advertised?

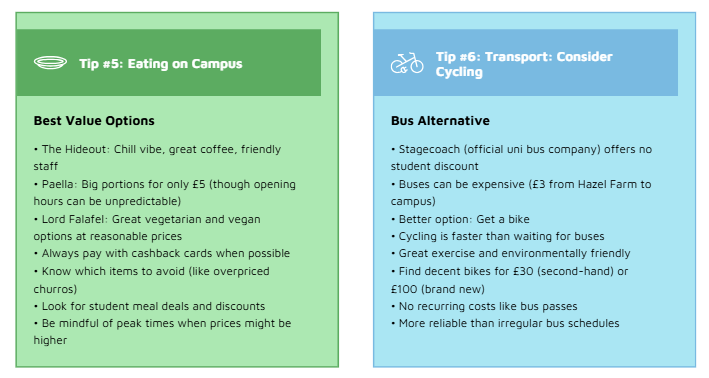

(Tip 5) Eating on Campus (Without Going Broke)

Sometimes you need something quick but that doesn’t mean expensive.

My Go-To Spots:

- The Hideout: Chill vibe, great coffee, friendly staff.

- Paella: Big portions, only £5.

- Skip the churros though trust me.

- Lord Falafel: Great vegetarian/vegan options.

⚠️ Note: Paella opening hours are… “flexible.”

And don’t forget to pay with Amex cashback, always!

(Tip 6) Transport: Buses = Chaos

Let’s talk buses in Guildford…

- Stagecoach (the official uni bus company) offers no student discount.

- Meanwhile, other providers do.

- It’s £3 from Hazel Farm to campus, ridiculous!

Better Option: Get a Bike

- Faster than the bus

- No waiting around

- Great exercise

- You can find decent bikes for:

- £30 (second-hand)

- £100 (brand new)

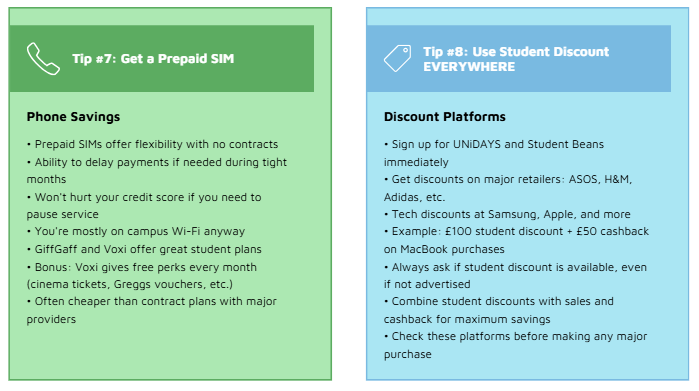

(Tip 7) Get a Prepaid SIM

Prepaid SIMs = flexibility.

Benefits:

- No contracts

- Delay payments if needed

- Won’t hurt your credit score

- You’re mostly on Wi-Fi anyway

GiftGaff and Voxy offer great student plans.

Bonus: Voxy gives free stuff every month (e.g. cinema tickets, Greggs vouchers, Glossybox).

(Tip 8) Use Student Discount EVERYWHERE

That £50 cashback on my MacBook? I also got £100 student discount.

Sign Up For:

- UNiDAYS

- Student Beans

You’ll get discounts on:

- ASOS

- H&M

- Adidas

- Samsung

- Apple

- …and loads more.

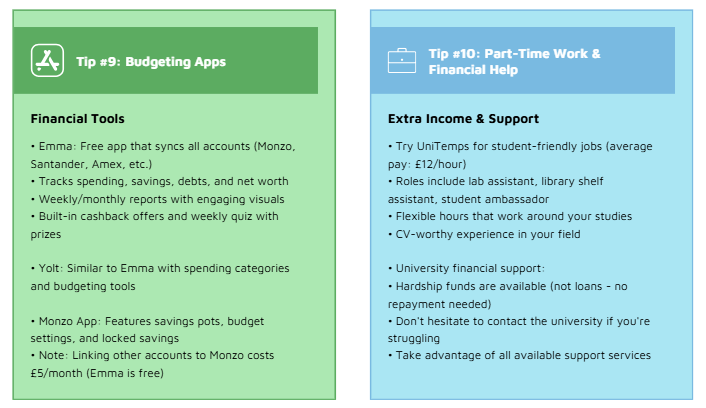

(Tip 9) Budgeting Apps I Use (and Love)

1. Emma

- Syncs all your accounts (Monzo, Santander, Amex, etc.)

- Tracks:

- Spending

- Savings

- Debts

- Net worth

- Weekly/monthly reports with memes 😂

- Cashback offers built-in

- Weekly quiz with chance to win £500

2. Yolt

- Similar to Emma

- Spending categories, reports, budgeting tools

3. Monzo App

- Pots for saving

- Budget settings

- Locked savings options

- Note: Linking other accounts costs £5/month (Emma is free)

(Tip 10) Part-Time Work = Extra Cash

You already know about retail and hospitality jobs, so here’s a better option:

Try: UniTemps

- Average pay: £12/hour

- Roles include:

- Lab assistant

- Library shelf assistant

- Student ambassador

- Flexible, student-friendly, and CV-worthy

I’m a lab demonstrator for Computer Science, it’s a great experience.

Financial Help From the University

If you’re in financial difficulty, please don’t hesitate to contact the university.

- They offer hardship funds and it’s not a loan

- You don’t need to repay it

The uni is here to help so take advantage of that support.

💬 Summary

These are all of my budgeting and student finance tips so far, I really hope some of these help you save or even make some extra money.

Thanks for reading, see you in the next one!