Stock Market For Beginners, Investing Step By Step

This is the best piece of advice I’ve ever heard about investing. It came from a millionaire I looked up to as a kid. After overhearing him talk about investing, I wanted to get involved. But as a complete beginner, I didn’t know where to start. So I asked him: how do I pick the right stocks to invest in? His answer was very simple:

Treat it like finding a girlfriend.

This is quite a clever way to look at it because when you buy a share in a company, you actually become a part-owner. This is like a partnership between you and the company. And just like a relationship, you want to make sure it’s happy, long, and successful.

But look, I’m not going to pretend that there’s a crystal ball that can tell you when to buy a stock before it rockets in value, like most of the fake gurus online. However, there are certainly a few things you can do to tip the odds in your favor.

Step One: Have a Strategy

When you’re looking for a partner, you need to have a strategy in mind. Are you going to shower them with gifts like a simp, or treat them mean to keep them keen? You’ll get very different results depending on which strategy you choose. And the same goes for stocks.

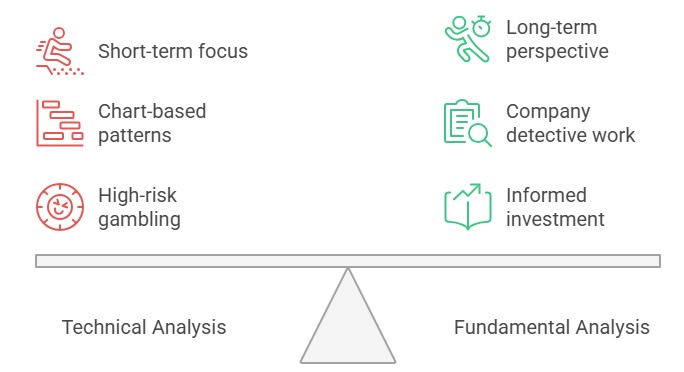

So just like dating, you need to figure out how you’re going to approach the stock market so that you get the results you want. There are two strategies you can choose from: the technical or the fundamental approach.

Technical Analysis:

- Mainly for short-term day traders

- Uses charts and price action to identify patterns

- Supposedly helps predict short-term stock movement

- But in my opinion, most people using this strategy are glorified gamblers

- According to Motley Fool, more than 95% of day traders lose money

Fundamental Analysis:

- Like being a detective for a company

- You look at:

- Financial reports

- Brand recognition

- Leadership

- Helps you understand how a company is performing and its future potential

- Better suited for long-term investing (3 to 10 years)

I know saying this might ruin my watch time, but I only want people getting into this for the right reasons. So if you’re looking for a way to get rich quick, stop watching. My goal is to secure your financial future, not just help you make a quick buck.

Also remember: with any kind of investing, your money can go down as well as up. If you’re still with me, comment down below “I’m in” so I know how many of you are willing to invest for the long term.

Step Two: Reading the Company’s Profile (a.k.a. The Balance Sheet)

When you’re on a dating app, you usually look at someone’s pictures and read their bio. It’s exactly the same when you’re thinking about investing in a company. You have to check out the company’s profile—called a balance sheet.

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It details:

- Assets

- Liabilities

- Shareholders’ equity

Quick Analogy:

Think of it like a cookie jar:

- Current assets: Cookies you can grab and eat (cash or anything turned into cash within 12 months)

- Long-term assets: Cookies deeper in the jar (e.g. headquarters, equipment)

- Intangible assets: The invisible things that make cookies taste good (e.g. patents, IP, trademarks, goodwill)

- Liabilities: Cookies you owe your friends for borrowing ingredients

The most important metric: Current Assets / Current Liabilities

- A good rule of thumb: The result should be above 1

- Example with Coca-Cola:

- Current Assets = $26.73B

- Current Liabilities = $23.57B

- Ratio = 1.13

- Means they have enough short-term assets to cover short-term debts

Step Three: The Income Statement

When getting to know someone new, you’re probably curious about their past relationships. Same goes for companies.

An income statement is like a report card for a company. It tells you:

- How much money it made

- How much it spent

- The net income (profits after expenses)

Coca-Cola in 2023:

- Total Revenue: $45.75B

- Net Income: $10.71B

Why this matters:

Businesses have two main types of expenses:

- Cost of Revenue: Direct materials (e.g., fabric for t-shirts)

- Operating Expenses: Marketing, staff, etc.

Operating Income = Revenue – (Cost of Revenue + Operating Expenses)

Profitability Check:

- Operating Income / Total Revenue x 100

- Coca-Cola’s profit margin = ~25.7%

According to Tide Banking:

- 5% = Low margin

- 10% = Healthy

- 20% = High

Profitability is great but not everything. Amazon wasn’t profitable for years.

Step Four: The Cash Flow Statement

Let’s talk money management. The cash flow statement shows how much money is coming in and out of a company. It’s broken into three parts:

- Operating Activities: Money from selling products/services

- You want to see a positive number

- Investing Activities: Money spent/income from investments (e.g., equipment)

- A negative number isn’t bad if it shows reinvestment

- Financing Activities: Money from or paid to investors (e.g., dividends, loans)

- Watch for high dividends with negative cash flow

Example: Coca-Cola gave away $7.95B in dividends but had positive cash flow, so it’s sustainable.

Step Five: Qualitative Analysis

Not everything is about numbers. Qualitative analysis is about the story behind the data.

Look for:

- Brand Recognition:

- Apple vs Xiaomi example

- Strong brands = trust = less risk

- Leadership:

- Check CEO history, experience, and influence (e.g., tweets that move markets)

- Example: Trump’s tweet once dropped Lockheed Martin stock by 2.5% in a day

- Competitive Advantages:

- Patents, loyal customers, unique models

- Example: Tesla’s tech and charging network

Step Six: Avoid Panic Selling

Don’t dump a stock based on bad news without investigating. Panic selling is often driven by headlines, not facts.

Example:

- Facebook’s Cambridge Analytica scandal dropped its stock 18% in 10 days

- Long-term holders saw over 200% gains since then

Sell when:

- You face a financial emergency

- You hit a financial goal (e.g. vacation)

- You no longer believe in the company’s fundamentals

Step Seven: Understand Stock Types

Just like dating different people, it’s important to explore different types of stocks:

Value Stocks:

- Well-known companies

- Low PE ratio

- Stable, pay dividends

- Common in: Consumer staples, energy, financials, industrials

- Examples: Berkshire Hathaway, Procter & Gamble, JP Morgan

Growth Stocks:

- Often overvalued, volatile

- High PE ratio

- Reinvest earnings, little to no dividends

- Examples: Amazon, Meta, Nvidia, Tesla

Quick PE Ratio Check:

- Average = 20-25

- <20 = Value

- 25 = Growth

- Compare within industry

Step Eight: Diversify Your Portfolio

Diversification = not putting all your eggs in one basket.

- No more than 5% in one stock

- No more than 20% in one sector

- Include:

- At least 5 sectors

- At least 2 countries

- More than 25 stocks

Also consider:

- A Cash ISA (UK-specific savings account with tax-free interest)

- Trading 212 offers 5.2% currently

Don’t Want to Pick Stocks?

If all this seems overwhelming, there’s a simple option: Index Fund investing.