How to Save $8,000 Fast on a Low Income

You got to be creative about coming up with some type of solutions that may be outside the ordinary from what you’re normally used to doing.

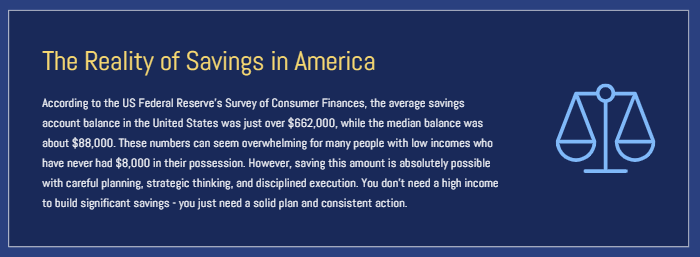

According to the US Federal Reserve’s most recent Survey of Consumer Finances:

- The average savings account balance in the United States was just over $662,000.

- The median balance in a savings account per person was about $88,000.

Now I know there’s a lot of people out there that have never even had $8,000 in their possession, in their savings account mainly because of a low income.

So in this post, I want to give you nine things to quickly save up $8,000 fast if you have a low income and just don’t make a lot of money.

This is very relevant for anyone, whether you’re trying to save up $5,000, $8,000, $10,000, or even $20,000.

Because I know saving $8,000 for anybody can seem like a daunting task, something that feels impossible. But listen, it’s possible. With some careful planning, strategizing, and discipline, you can do it. You got this.

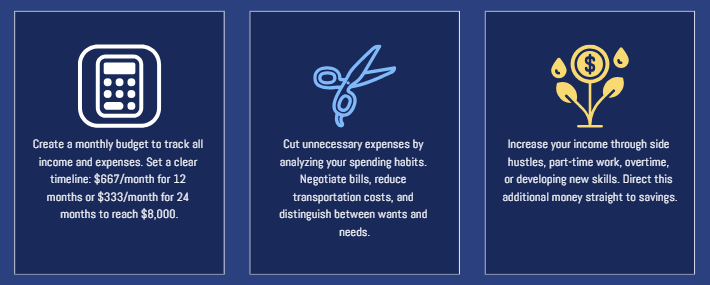

1. Do a Monthly Budget

- Track your money every month.

- Write it down on paper, Excel, or Google Sheets.

- Every month is different, so your budget should be unique.

It doesn’t matter if you only bring home $200 a month or $20,000 a month, everybody needs a budget. A budget helps you:

- Control your money and spending

- Track your income and expenses

- See clearly where you are financially

On your budget, figure out your wants vs. needs. Then set a savings goal of $8,000.

Example savings timelines:

- Save in 6 months → $1,333/month

- Save in 12 months → $667/month

- Save in 24 months → $333/month

It’s just math. You define the time frame, and that drives your decisions.

2. Cut Expenses

Look at your budget and ask:

- How do I cut unnecessary costs?

- Can I reduce or negotiate bills?

- Can I use public transportation or drive less?

Analyze where you spend and figure out where to cut.

3. Increase Your Income

Bringing in more money is one of the most important things you can do. Not to spend on wants, but to add toward your savings goal.

Ideas include:

- Side hustles or freelance work

- A part-time job

- Overtime at your current job

- Increasing your skills (certifications, training, education)

More income means you can reach your $8,000 faster.

4. Automate Your Savings

Set up automatic transfers so you don’t see the money.

Example: If you earn $1,000 a week, have a set amount go directly into a high yield savings account every payday.

This removes temptation because the money never sits in your pocket. Discipline is easier when it’s automated.

5. Take a Vow of Frugality

Promise yourself to spend less. Be consistent, persistent, and focused.

- Embrace minimalism and frugal living

- Try do-it-yourself projects instead of hiring

- Use coupons and discounts

You have to make some changes if you want to see changes in your money.

6. Avoid Debt

Say no to new debt. The money you’d use to make debt payments should go to savings instead.

- Stop using credit cards

- Use cash instead

- Build your emergency fund with the money you save

Debt steals from your savings goal, so declare no more debt.

7. Use Windfalls Wisely

If you receive extra money, put it toward your $8,000 savings goal:

- Tax returns

- Job bonuses

- Unexpected earnings

On a low income, every dollar counts. Be intentional about windfalls they’re your shortcut to saving faster.

8. Find Free or Cheap Entertainment

You don’t have to cut joy from your life, just find inexpensive options:

- Borrow books from the library

- Go to free community concerts or events

- Cook your favorite food at home

- Take walks in nature

- Dance to your favorite music

Frugal self care helps you stay motivated while saving.

9. Review and Adjust Regularly

Stay intense and laser-focused by checking in monthly:

- Keep doing a monthly budget

- Look for ways to increase income

- Reassess expenses

Avoid the temptation of rewarding yourself too early. Stay disciplined until you hit your savings goal.

Celebrate small milestones along the way, but keep your eyes on the $8,000 target.

The Barriers People Face

Why do people struggle to save?

- Psychological blocks: lack of belief, negative thoughts about money

- Lack of financial literacy: not knowing how or where to start

- Poor habits: immediate gratification, overspending

- Debt: especially hard with a low income

- Rising costs: inflation, rent, living expenses

- Social pressure: trying to “keep up with the Joneses”

Summary

Here’s the plan in summary:

- Write a detailed monthly budget

- Track income and expenses

- Lower expenses where possible

- Raise your income with new skills or side work

- Automate savings into a high yield account

- Use windfalls toward your goal

- Be frugal, avoid debt, and review monthly

If you stick to this, you can save $8,000 fast, even on a low income.

Remember: The best person to take care of the old you is the young you.

Take care of yourself, and take care of others.

Until the next one, peace✌️.