Compound Interest Explained Simply: How It Grows Your Wealth Over Time

Today we’re going to talk about compound interest, and I’m going to explain it in an easy and visual way for beginners. By the end of this post, you should have an idea about how compound interest works and applies to your investments—as well as how it indirectly affects your wealth through fund management fees. This is something you should absolutely be aware of.

I’ll also share an easy rule of thumb on how to calculate the doubling time of an investment at a specific interest rate. And make sure to read until the end if you want to know how many days it takes to reach $1 million if you start with just one dollar and double your money each day.

What Is Compound Interest?

Compound interest, or “interest on interest,” is this almost magical thing that you need to use to get your investments to grow. Whether you keep your money in a savings account, invest in stocks, or use any other method where you get interest returns—this is one of the most basic concepts that you need to understand to make smart decisions for your personal finances and take control over your future.

I wish I would have learned this earlier, because time invested is the most important factor for the end result.

There’s a good reason why Einstein himself called compound interest the 8th wonder of the world—one of the most powerful forces in the universe.

And who am I to go against one of the world’s most intelligent people?

Why Is Compound Interest So Powerful?

Compound interest lets your investments and savings grow by themselves—while you sleep, eat, or watch YouTube videos. Yep, I know what you’re doing.

With compound interest, your money works for you and grows exponentially, like the snowball effect.

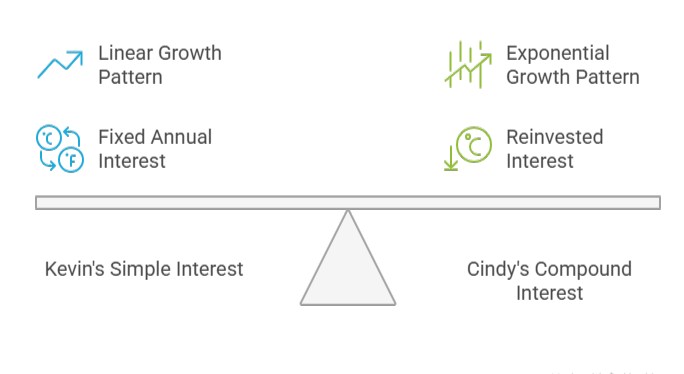

Simple Interest vs. Compound Interest

To understand compound interest, first you have to understand simple interest.

Meet Kevin and Cindy

- Both are 30 years old and want to invest for 30 years for their pensions.

- Both have $1,000 to invest at a 10% annual interest rate.

Kevin’s Simple Interest:

- Kevin gets $100 interest every year and withdraws it.

- After 1 year: $1,100 total.

- After 2 years: $1,200 total.

- After 3 years: $1,300 total.

He gets $100 of interest each year, for 30 years, which gives him $3,000 in interest.

Since he doesn’t reinvest that interest, he doesn’t get compound interest.

➡️ Total: $4,000 after 30 years

Cindy’s Compound Interest:

- Cindy also gets 10% annually, but she leaves the money invested.

Here’s what happens:

- After 1 year: $1,100 (same as Kevin)

- After 2 years: $1,210 (10% of $1,100 = $110)

- After 3 years: $1,331 (10% of $1,210 = $121)

And it keeps compounding.

Visualizing It

- Kevin’s money grows linearly.

- Cindy’s money grows exponentially.

Cindy’s Timeline:

- After 9 years: $1,000 doubles to $2,000

- 4 more years: $3,000

- Less than 3 more years: $4,000

- And it just keeps going…

Kevin doesn’t get this snowball effect.

The Rule of 72: Doubling Time

A simple rule to estimate how long it takes your investment to double is the:

Rule of 72

Doubling time = 72 ÷ interest rate

Examples:

- 1% return → 72 years

- 2% return → 36 years

- 10% return → 7.2 years

💡 If you’re only earning 1% (like many savings accounts), your money will actually lose value due to inflation being higher than 1%.

From $1 to $1 Million by Doubling Daily?

Imagine starting with $1 and doubling it every day:

- Day 1: $1

- Day 2: $2

- Day 3: $4

- Day 4: $8

…

Do you know how long it takes to reach $1 million?

21 days

Now, of course, this isn’t realistic unless you’re in a casino with extreme luck. But this demonstrates just how powerful compound growth really is.

What Affects Compound Interest Growth?

The amount you accumulate depends on:

- Interest Rate – higher rates = faster growth (but usually higher risk)

- Principal – more upfront money = more growth

- Time – the most important factor

Example:

If you don’t have 30 years like Cindy, you need a higher principal:

- 20 years = need $2,600 to reach the same amount (2.6x more)

- 10 years = need $6,700 (6.7x more)

➡️ If you’re young, time is your best friend.

➡️ If you’re starting later, try to invest higher amounts—but even small amounts help over time.

Does Compound Interest Only Work for Savings Accounts?

No! Compound interest works with any investment where you earn a return:

- Stocks

- Bonds

- Index funds

- Mutual funds

Delayed Gratification vs. Immediate Spending

Every dollar you spend today has a future value if you had invested it instead.

Let’s look at some examples:

- $5 coffee today = $80 in 30 years (10% interest)

- $10 lunch = $160 in 30 years

Now, I’m not saying never buy coffee or lunch. But it’s good to be aware.

- One coffee/week = $260/year

➡️ In 30 years = $4,100 - One lunch/week = $520/year

➡️ In 30 years = $8,200

Still worth it?

How Fees Eat into Compound Growth

Compound interest also shows how management fees eat into your long-term returns.

- Fees accumulate and

- They reduce your compounding base

Cindy with Fees:

Let’s say she invested with a fund fee:

- 0.2% fee (index fund) → she keeps 94% of her returns after 30 years

- 2% fee (mutual fund) → she keeps only 56%

Banks often say: “It’s only 2% per year”

But after 30 years, you keep just over half of what you could’ve had.

So, Should You Always Choose the Lowest-Fee Fund?

Not always.

- If an actively managed fund can beat its benchmark, it might justify the fee.

- But beware: many “active” funds are actually disguised passive funds. They charge more but mimic an index—and end up performing worse.

We’ll dive into fund types in another posts.

In short

Compound interest is one of the most powerful concepts in personal finance. It’s something that can truly transform your wealth over time—if you understand it and use it wisely.

“The best time to start was yesterday. The second-best time is today.”

Start small, start now—and let time do the heavy lifting.