What’s the Fuss About Zero-Based Budgeting?

Have you heard of zero-based budgeting but you don’t know what all the fuss is about? In this blog, we’ll dive into the world of budgeting and explore how to make this budgeting technique work for you.

What’s up, fam! Welcome to Leafyleap. On this blog, I teach you how to keep your lattes, while indulging in avocado toast too, if you like! Today, we’re going to discuss a powerful budgeting method called the zero base budget. This means that every dollar you have has a job, but it’s perfect for beginners, and it helps you take control of your finances.

Like I said, a zero-based budget is a budgeting method where your income minus your expenses equals zero. That means every dollar has a job, every dollar has a name. You know where every dollar of your income is going , whether it’s for bills, saving, or discretionary spending. The goal is to ensure you’re not overspending and that you’re using your money efficiently.

This is different from other budgeting methods like the 50/30/20 method, where 50% goes to needs, 30% to something else, and 20% to something else, but it’s pretty common to combine zero based budgeting with the cash envelope system , which is why you see it on that show, okay? You also see me talk about it all the time ;

But I love it because it’s a very visual way of tracking how much money you spent during each pay period.

Why Should You Choose a Zero-Based Budget?

The zero-based budget, like I said, is an excellent choice for beginners because it’s straightforward and easy to understand. It encourages you to be intentional with your spending and helps you identify areas where you can cut back and save even more money. This is especially true if your main issue is overspending or just not knowing where your money’s going. A lot of us have had that problem , like, we know we make good money but we just don’t know where the money is going, and a zero based budget, combined with the cash envelope system, can help you figure that out.

Plus, it’s a flexible budgeting method that can be adapted to your financial situation. There’s no arbitrary percentage to squeeze your spending and goals into, like the 50/30/20 method, so this is always my choice and recommendation if you’re just starting out on your budgeting journey.

How Do You Actually Create a Zero-Based Budget?

I’m going to take you through a few steps on how to actually do this and give you some tips on how to do it well.

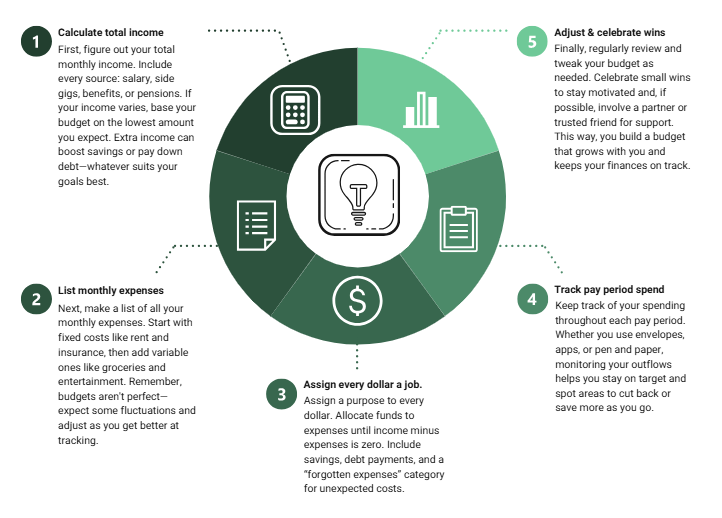

Step 1: Calculate your monthly income.

Include all your sources of income: salary, side hustles, any other regular earnings, disability, Social Security, pension all of those things. If your income is variable or you work in a commission based job or field (like you’re a real estate agent or you sell cars), then budget for the least amount of money you get every month. If you get more than that, use it to either beef up your envelopes or save or pay off debt, whatever your goals are telling you to do.

Step 2: List your monthly expenses.

Start with fixed expenses like rent, mortgage, and insurance, and then add variable expenses such as groceries, transportation, and entertainment. Now, it seems strange to say groceries are a variable expense, I budget the same amount for groceries every month, so for me it’s more of a fixed expense, but for you , for most people, it is variable. It’s necessary, but it’s variable because we tend not to spend the same every month. Also in Step 2, remember there’s no such thing as a perfect month, so there’s no perfect budget, but the longer you do this, the better you’ll get at it.

Step 3: Assign every dollar a purpose.

Allocate your income to each expense category until your income minus expenses equals zero there should not be any money left over. Remember to include savings goals and debt repayment in your budget. One of the other categories I like to put in my budget is the “stuff I forgot.” You’ve seen that in my blogs , it’s the “stuff I forgot” envelope and that is for exactly what it says. Some people call it other things, but it’s basically for the things your family forgot to tell you about, the things you just forgot to budget for, and as you budget more, you’ll be able to figure out how much you actually need in an envelope like that. Typically, it’s for last minute gifts, stuff at school, maybe emergencies if you haven’t beefed up your emergency fund yet, or medical expenses fund. So that’s typically what goes in the “stuff I forgot” envelope.

You’ll also find that as you do the budget more, you’ll probably spend more than you thought on groceries and eating out, and there’s always something you forgot to budget for so keep that in mind for the next budget.

Step 4: Track your spending throughout the month or each pay period.

Track your spending to ensure you’re sticking to your budget. This is also why I like to pair it with the envelopes system because, like I said, it’s a hard visual on how much you’re actually spending and how much money you have left.

Adjust your budget as needed to accommodate any changes in your financial situation. This is especially important in cases of a medical emergency or job loss. As you track your spending, make note of whether your spending was for a want or a need , this way, if you have to cut your expenses, you’ll have an easier time knowing what to cut out, even if you’re cutting it just for a temporary period of time. As for where to track it, it doesn’t actually matter , pen and paper, an app, the notes app on your phone, they all work, so just pick the method that makes the most sense to you.

Tips for Succeeding with Your Zero-Based Budget

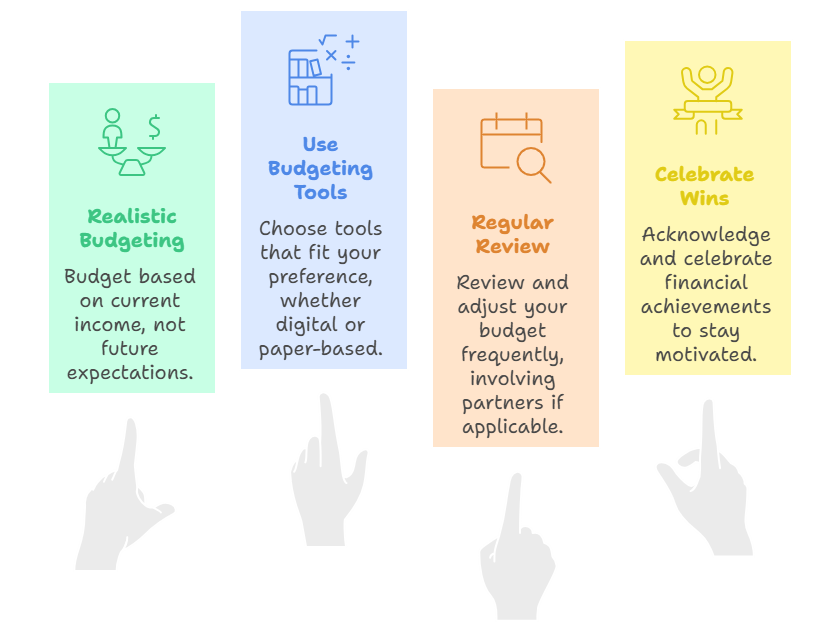

- Be realistic with your budget categories and amounts. I budget per pay period rather than the whole month, so you should always budget with the money you have, not what you think you’re going to get. That’s why my budgeting sheets have two columns, one for the budgeted amount and one for the actual amount, so you can see the difference and adjust from there.

- Use budgeting tools or apps to help track your spending. Again, I have paper-based tools that’s what I prefer, but if you’re an app-based person or you like spreadsheets, definitely do that as well.

- Review and adjust your budget regularly to stay on track. If you’re married or share expenses with someone, include them in your financial planning. They should have a say in the budget. You should have money conversations at least once per week to make sure everyone is on the same page. If you live alone and don’t have someone for accountability, see if you can get a trusted friend or family member to provide a safe space for you.

- Celebrate your financial wins, no matter how small! Maybe you didn’t buy that case of soda and your health got better because of it, or you fixed something instead of buying new. Whatever it is, celebrate it! Keep a list of wins on your phone so that when you feel like you’re not winning, you can refer back and see what you’ve accomplished.

With a zero-based budget, you can take control of your finances, work towards your goals, pay off debt, and create generational wealth , all with a budget.

Hey, if you enjoyed this article, maybe try my newsletter.