Why You Need a Rainy Day Fund (and How to Build One)

In last week’s blog about budgeting, I mentioned how I set aside some money every month for my rainy day fund savings. For me, that amount was $350 every single month.

Rainy day funds are incredibly important. In fact, one of my subscribers, Someone asked me to share more details about them. So today, let’s talk about:

- What a rainy day fund is

- How much money you should have in it

- Where to keep (or “invest”) it

What Is a Rainy Day (Emergency) Fund?

As the name suggests, it’s money set aside to give you shelter during “rainy days.”

In other words, it’s cash reserved only for emergencies.

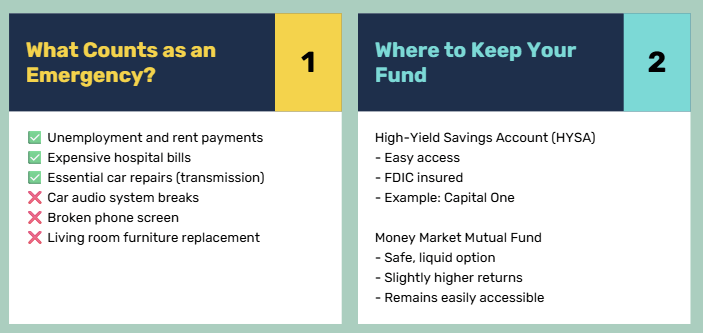

Here’s a quick game to help you figure out what counts as an emergency:

- You become unemployed and need to cover rent. → ✅ Yes, use your emergency fund.

- You get into an accident and have an expensive hospital bill. → ✅ Yes, rainy day.

- Your car audio system breaks. → ❌ Nope, not an emergency. Use headphones.

- Your iPhone screen breaks. → ❌ Nope, inconvenient but not an emergency.

- Your car transmission breaks. → ✅ Yes, because you need your car to get to work.

- Your living room furniture breaks. → ❌ Nope, sitting on the floor is not an emergency.

How to Build a Rainy Day Fund

Building up your rainy day fund is a process, so start with incremental goals. I recommend three stages:

- Save $1,000

- This is your starter emergency fund.

- Save 3 Months of Living Expenses

- Living expenses = fixed costs + variable costs.

- Examples: housing, utilities, groceries, transportation.

- Excludes “free money” spending like entertainment, since if you’re unemployed, you’ll cut that out anyway.

- Take your monthly fixed + variable costs, multiply by 3 = your target.

- Save 6+ Months of Living Expenses

- Dave Ramsey suggests six months.

- Some books (like I Will Teach You to Be Rich) even recommend aiming for a full year.

- Anything above 3 months depends on your personal situation.

Where Should You Keep a Rainy Day Fund?

Short answer: nowhere “risky.”

A rainy day fund is not an investment. It’s a cost, like insurance.

Think of it like this:

- You pay car insurance every month, knowing you won’t “make money” from it unless there’s an accident.

- Same with an emergency fund, it loses value to inflation, but you need it for peace of mind.

So, where should you actually keep it?

- High-Yield Savings Account (HYSA)

- Easy access.

- FDIC insured.

- Example: Capital One (what I personally use).

- Money Market Mutual Fund

- Also safe.

- Can give you a slightly higher return.

- A bit harder to understand.

👉 If you want me to go deeper into money market funds (what they are and which ones you could use), let me know in the comments.

Why It Matters

Emergencies often come in clusters.

I like to say: “You only crash your car the same week that you twist your ankle.”

A few years ago, I became unemployed because my visa expired. At the same time, I got hit with an expensive car repair bill and a big rent increase. If I hadn’t built up my emergency fund, I might have been evicted.

That’s why it’s so important to:

- Save consistently.

- Be disciplined about not touching your fund unless it’s a real emergency.

Keep working at it, and future-you will thank you.

See you next time ✌️