Build a Solid Dividend Stock Portfolio

In this blog, I am going to show you exactly how to build a solid dividend stock PortCo step by step. We’re going to cover everything you need to know when it comes to investing in dividend stocks. I’ll show you all the things you will ever need to know to build a high-quality dividend portfolio today. Let’s get started.

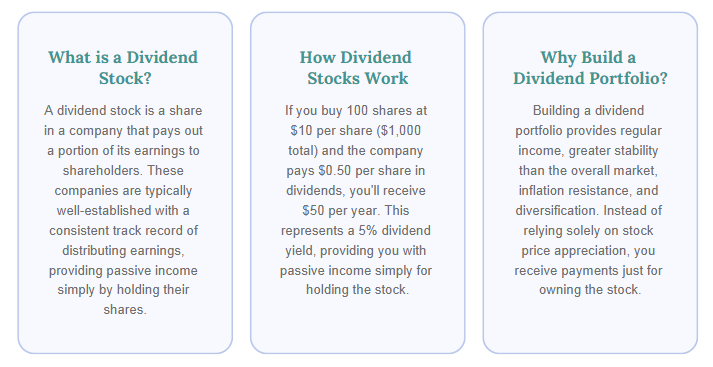

What is a Dividend Stock?

So, first of all, what is a dividend stock?

A dividend stock is a stock or company that pays some of its earnings to shareholders.

Basically, this means that investors earn money simply by holding shares of a dividend-paying company. When you do this, it results in passive income for you as the shareholder.

Dividend stocks are usually well established companies with a track record of distributing earnings back to shareholders.

How Do Dividend Stocks Work?

Imagine you buy 100 shares of a company at $10 per share. That means you spend $1,000 in total.

Now, let’s say this company pays out $0.50 in dividends per share.

- If you invested $1,000 → you’ll receive $50 per year.

- That equals a 5% dividend yield.

- That $50 is your dividend payment, your passive income from holding the stock.

Why Build a Dividend Portfolio?

There are several reasons why building a dividend stock portfolio makes sense:

- Regular income → Instead of only relying on a stock’s price going up, you actually receive payments just for owning it.

- Safety and stability → Dividend portfolios are historically more stable than the overall market.

- Inflation resistance & diversification → Dividend-paying blue-chip companies provide reliable income while balancing market fluctuations.

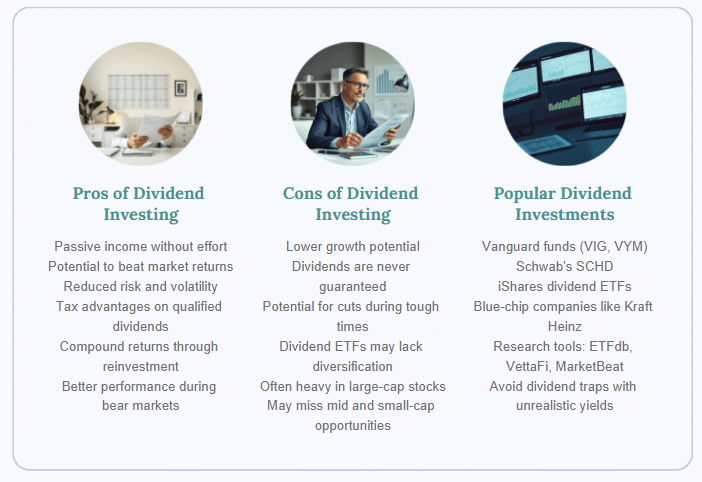

Pros of Dividend Investing

Some of the biggest advantages include:

- Passive income: You make money without doing anything.

- Often beats the market: Returns can be higher once you factor in dividends.

- Reduced risk and volatility: Dividend stocks grow slower but are more stable.

- Tax advantages: Qualified dividends are taxed at lower long-term capital gains rates.

- Compound returns: Reinvest dividends to buy more shares → leading to exponential long-term growth.

- Outperforms in bear markets: Dividend stocks tend to hold value better during downturns.

Cons of Dividend Investing

Of course, there are trade-offs too:

- Lower growth: Companies pay money out to shareholders instead of reinvesting heavily in their business.

- Dividends are never guaranteed: Companies can suspend or cut payments in tough times.

- Dividend ETFs may lack diversification: Often heavy in large caps, missing mid- and small-cap opportunities.

Popular Dividend Stocks & ETFs

Some popular dividend-paying stocks and ETFs include:

- Vanguard funds (VIG, VYM)

- Schwab’s SCHD

- iShares dividend ETFs

- Blue-chip companies like Kraft Heinz (KHC)

Websites like ETFdb / VettaFi and MarketBeat let you explore dividend yields, expense ratios, and analyst reports. But remember → avoid dividend traps (companies with unrealistically high yields, like 20–60%).

Steps to Build Your Dividend Portfolio

Here’s the process:

- Open a brokerage account (Robinhood, WeBull, Moomoo, etc.)

- Deposit money into it

- Choose your investments

- Buy your stocks or ETFs

All brokerage apps work essentially the same way. Brokerage choice matters less than following through and actually buying your shares.

Key Metrics to Consider

When analyzing dividend stocks, keep an eye on:

- 10-year average return

- Dividend yield (but avoid dividend traps!)

- Diversification (spread across industries/sectors)

- Expense ratio (for ETFs → aim below 0.1%)

- Total return = price appreciation + dividends

- Earnings per share (EPS) and growth over time

- Payout ratio (aim for under 60%)

Mistakes to Avoid

- Buying only high-yield “dividend traps”

- Failing to diversify across industries

- Ignoring company financial stability

- Skipping due diligence (1 hr research per company is a good rule)

- Not reinvesting dividends if you don’t need the income immediately

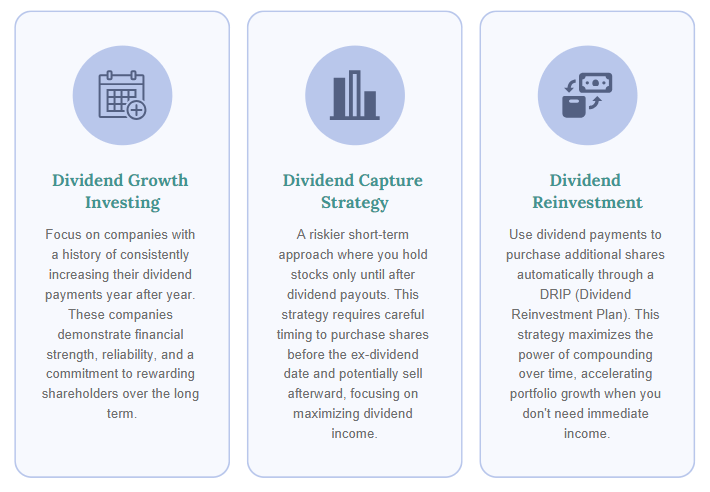

Dividend Investment Strategies

There are three main approaches:

- Dividend growth investing → Buy companies that consistently increase dividends.

- Dividend capture investing → Riskier short-term strategy of holding stocks only until after payouts.

- Reinvesting dividends → Use payouts to buy more shares and maximize compounding.

Key Warnings About Dividend Traps

High yields can be dangerous. To analyze a stock, check:

- Price-to-earnings ratio (P/E)

- Free cash flow (cash left after expenses — must be higher than payouts)

- Debt-to-equity ratio (too much debt = risky for dividend sustainability)

Long-Term Perspective

Dividend investing is not a get-rich-quick scheme. Instead, it’s a strategy for sustainable passive income over decades.

For example:

- A $1M portfolio with a 3% yield = $30,000/year in dividend income.

- The portfolio value might not grow as fast as high-growth tech stocks, but you’ll get steady, reliable income.

In Conclusion

Dividend stocks are becoming more popular, especially as high growth tech stocks have struggled recently. Many dividend stocks have held their value and continued to pay investors consistently.

Key takeaway: Dividend investing is a great way to diversify your portfolio, reduce risk, and enjoy steady passive income but it shouldn’t be your only investment strategy.