Saving More vs. Earning More: Which Should You Focus On?

Warren Buffett is famously frugal and has said:

“Do not save what is left after spending, but spend what is left after saving.”

On the other hand, every 20-something’s idol professional visionary and amateur clown Elon Musk is reported to have said:

“Making an extra $10K is easier than trying to save $10K. The sooner you understand that, the sooner your life will improve.”

But these individuals are very far removed from the everyday experience of regular people.

(It’s like a deep-fried songbird , you eat it whole. Oh my God.)

So what school of thought will yield the best results for regular individuals: saving more or earning more?

The Common Assumptions

I know what a lot of you are thinking.

Some of you might look at this debate and say:

“The answer is simple — just earn more.”

Others might think:

“No, it’s simple — you just have to save more.”

In this discussion, I’m going to explore the nuance of saving more versus earning more — aspects that are rarely discussed.

A Quick Disclaimer

First, I’m only going to discuss about income earned by working for an employer.

- In the US, that means W2 income.

- In Canada, the equivalent is T4 income.

I’m not talking about:

- Income from running a business

- Income from passive or semi-passive investments

The dynamics of those are far more complex and deserve their own separate discussion.

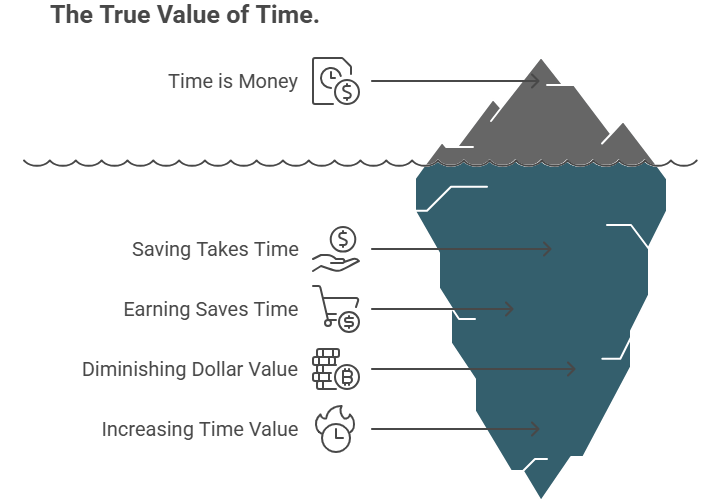

Time Is Money

Let’s start with the truism: time is money.

We need time to make money, and if we have money, we can trade it for time.

Time and money are interchangeable, but the exchange rate between them changes over the course of one’s life.

- Saving takes time — cooking meals, clipping coupons, fixing your own plumbing.

- Earning more can save time — ordering food, hiring cleaners, paying for repairs.

The wealthier you become, the less you value each marginal dollar.

But there is no diminishing return on free time, time only moves forward, and our time on Earth is always decreasing.

So every marginal minute becomes more valuable as life progresses.

Extreme Example: Marissa Mayer

Marissa Mayer, former president and CEO of Yahoo, reportedly worked 130-hour weeks.

That left her only 5.4 hours per day outside of work not just for sleep, but for everything.

She had to carefully time showers, meals, and even bathroom breaks.

She reportedly earned $900,000 per week, meaning her time was valued at $7,000 per hour.

It’s no surprise she likely outsourced everything unrelated to work.

On the extreme end, billionaires hire chefs, assistants, and cleaners to handle all their mundane chores, because their time is so valuable.

The Big Question: Save More or Earn More?

For most of us “normies,” the decision is less obvious. Here are five key considerations:

1. Each Additional Dollar Is Not Free

Usually, you earn more by:

- Taking on more challenging tasks

- Accepting more responsibility

- Working longer hours

This can increase stress and reduce your effective hourly pay.

While stress can make us more resilient, there’s good stress and bad stress and you don’t always know which one you’re signing up for.

2. Higher Earnings Are Taxed More

In most developed countries, progressive tax rates mean each extra chunk of income is taxed at a higher rate.

You keep less of every extra dollar you earn.

3. Diminishing Marginal Utility

The more you have of something, the less each extra bit matters.

Think of eating pizza:

- Slice 1: Amazing.

- Slice 2: Still great.

- Slice 3: Good, but you’re getting full.

- Slice 4: Meh.

- Slice 5: Why am I doing this?

If you make $50K/year, an extra $25K is life-changing.

If you make $500K/year, an extra $250K won’t have the same impact on happiness.

4. Income Increases Are Temporary

If you’re on W2/T4 income, your raise lasts only as long as you have your job.

Savings, however, are permanent, they reduce expenses forever and can generate investment returns indefinitely.

5. Saving Builds Financial Discipline

After a certain income level, saving more makes you more financially efficient.

Frugality is a skill and a lifestyle, one you should maintain at any income level.

Even Nicolas Cage, earning $20M per movie, blew through his wealth buying dinosaur skulls, castles, islands, albino cobras, and more.

You can’t out-earn terrible money habits.

The Sweet Spot

You want to hit an income sweet spot where:

- Stress is sustainable

- Income covers basic needs

- You have room for discretionary wants and investments

Once that’s achieved, focusing on saving more is often more optimal.

Takeaway

- Saving at any income level is a good habit, it’s essential for financial independence.

- If your income is low (often meaning below the median in your area), focus on earning more.

- Once you reach a point of diminishing returns due to taxes and stress, focus on optimizing savings.

- And of course, if you love your job or have passive income, the equation changes.

So should you save more or earn more?

The answer depends on where you are in your financial journey.