How to Invest $100: 8 Beginner Friendly Ideas (From Low to High Risk)

Have you ever had a hundred dollars in your pocket and wondered how you could turn it into a thousand, ten thousand, or even a hundred thousand dollars?

Sadly, this isn’t something they teach in school. Come to think of it, it would’ve been pretty awesome if they had. Because of this lack of knowledge, it can feel pretty scary for most beginners to get started in investing.

In this guide, I’m going to simplify the whole process. I started with less than $100, took calculated risks, and over time, grew my wealth. I’m not saying becoming rich is easy but by taking smart steps, you can build your wealth over time.

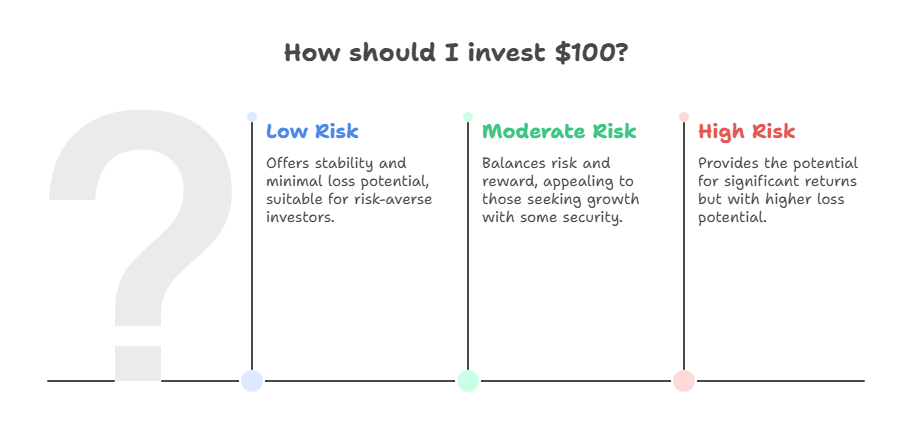

Today, I’m sharing how to invest for beginners with $100. As we go through the options, the risk will increase but remember: as risk goes up, so does potential reward.

I’ll also put my money where my mouth is and invest $100 into each one so you can see exactly how to do it.

1. Invest in Yourself (Skill & Knowledge Building)

When someone asks me how they should invest $100, I usually say: invest in yourself.

You can do this by:

- Buying books

- Taking online courses

- Improving your skills

Assuming you’ve already done that, let’s move on to the specific places you can put your money.

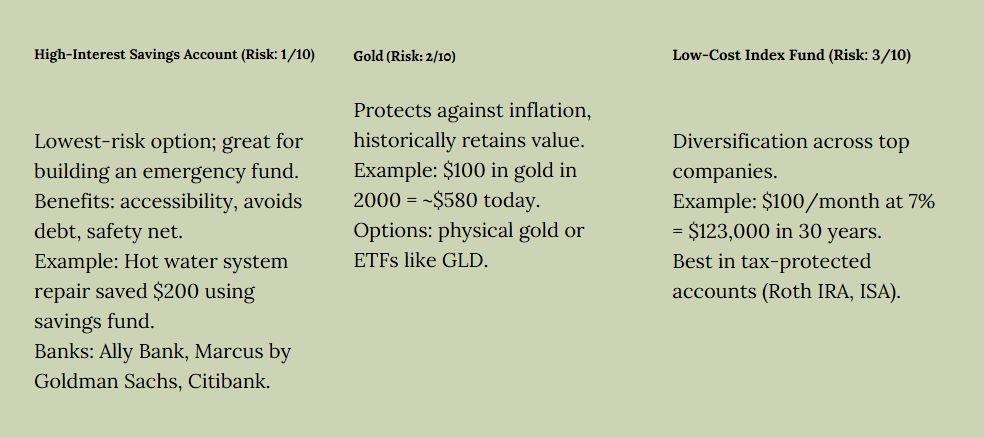

2. High-Interest Savings Account (Risk: 1/10)

This is the lowest risk possible. While it’s hard nowadays to find an account paying substantial interest, the real value here is starting your emergency fund.

Why it matters:

- Accessible money for unexpected expenses

- Avoid debt and high interest fees

- Financial safety net

Example:

When I bought my first apartment, my hot water system failed. My emergency fund saved me over $200 because I didn’t need a payday loan.

What to look for:

- A good interest rate (varies by economy)

- Instant access to funds

Banks worth checking:

- Ally Bank

- Marcus by Goldman Sachs

- Citibank

I currently use Marcus by Goldman Sachs with a 0.7% interest rate one of the best available right now.

✅ $100 deposited into my savings account ,done.

3. Gold (Risk: 2/10)

Gold is often called a “safe haven”. Since the creation of the Federal Reserve in 1913, the U.S. dollar has lost 95% of its value, gold helps protect against inflation.

Example:

A $100 gold nugget in 2000 is worth about $580 today.

Ways to invest:

- Physical gold (bars, coins, jewelry, but beware of markups)

- Gold ETFs (e.g., GLD on Robinhood or Trading 212)

I invested using Trading 212 in a similar share. With one click — I’m now Mr. Gold Man.

4. Low-Cost Index Fund (Risk: 3/10)

If you invested $100/month into an index fund at a 7% annual return, after 30 years you’d have $123,000 thanks to compound interest.

Why it’s great:

- Diversification (own bits of Apple, Microsoft, Amazon, Facebook, etc.)

- Proven long-term growth

- Low knowledge requirement

Tax-protected accounts:

- USA: Roth IRA

- UK: ISA

I invested $100 into an S&P 500 index fund through Vanguard.

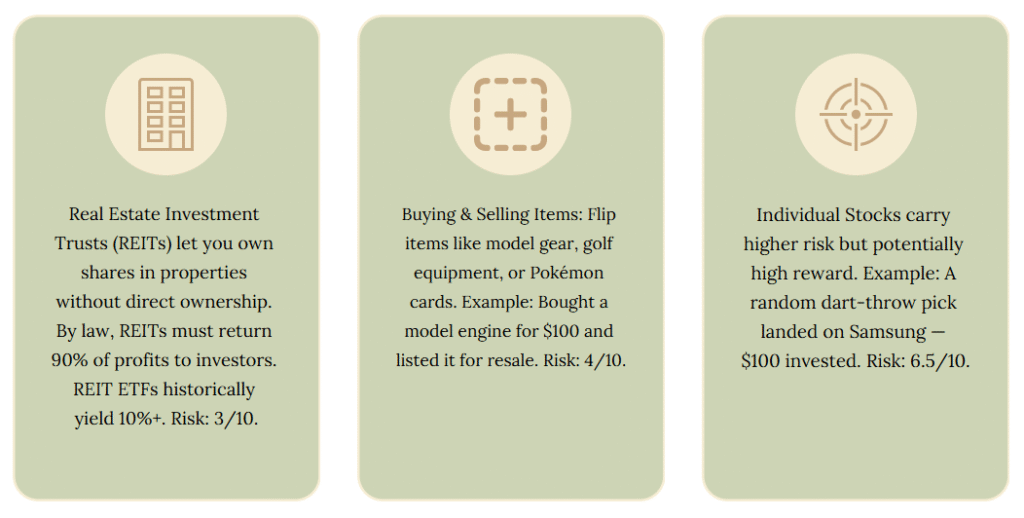

5. Real Estate Investment Trust (REIT) (Risk: 3/10)

A REIT lets you own a small piece of income-producing properties without buying them yourself.

- Own parts of offices, apartments, hotels, etc.

- By law, they pay 90% of profits to investors as dividends

- Historically, REIT ETFs have returned 10%+ annually

I invested $100 in a globally diversified REIT via Trading 212.

6. Buying & Selling Items (Risk: 4/10)

Flip items for profit especially in areas you know well.

Examples:

- Model gear

- Golf equipment

- Pokémon cards

I bought a model engine for about $100 and listed it on eBay and a niche site for model flying.

7. Individual Stocks (Risk: 6.5/10)

Risky but exciting, pick good companies and you can win big.

I even tried a dart-throw experiment to pick a stock randomly. My dart landed on Samsung, so I invested $100 there.

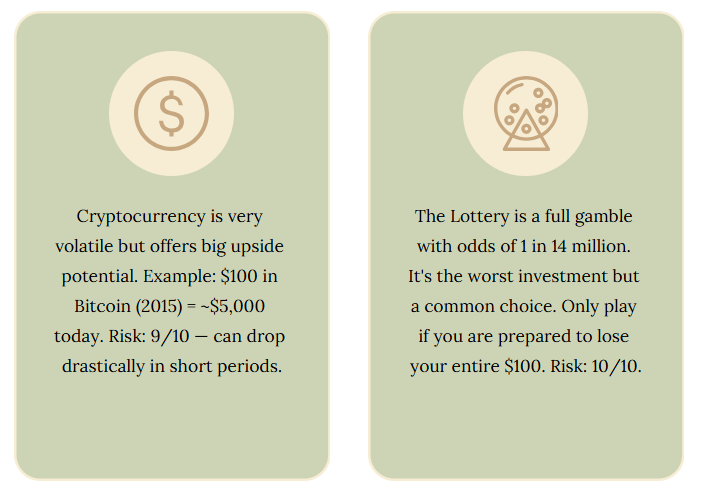

8. Cryptocurrency (Risk: 9/10)

Crypto is volatile but has huge upside potential.

Example:

$100 in Bitcoin in 2015 would be worth around $5,000 today, but $100 in 2017 could have dropped to $17 a year later.

I invested $100 into Bitcoin via Coinbase and will simply forget about it.

9. The Lottery (Risk: 10/10 — Full Gamble)

57% of Americans buy a lotto ticket each year. The odds of winning? 1 in 14 million.

They are one of the worst investment, i mean if you are ready to lose money then go ahead

Moral of the story

Every investment carries different levels of risk and reward. If you’re starting with $100:

- Begin with low-risk safety nets (savings, index funds)

- Gradually explore medium-risk growth options (REITs, stocks)

- Only gamble what you’re prepared to lose (crypto, lottery)