Fixed vs Variable vs Unexpected Expenses

How to Budget for Fixed, Variable, and Unexpected Expenses

Great job practicing those spreadsheet skills over the past few lessons! Those skills are going to come in handy as we start accounting for all your expenses.

Bills that stay the same each and every time are easy to predict, like rent or your phone bill. But how would you predict:

- Expenses that change every month (like going out to eat)?

- Bills that don’t happen every month (like getting your oil changed every six months)?

- Emergencies, which are by their very nature unpredictable?

Believe me, money does not grow on trees. I would know , i tried to plant one… a money tree. I didn’t get one, just a dirty dollar bill. But there’s good news for you:

Turns out, it’s pretty easy to account for all your different expenses. The key is to consider them as two separate sets:

- Fixed expenses

- Variable expenses

Fixed Expenses

First up, the easier expenses to account for: fixed expenses.

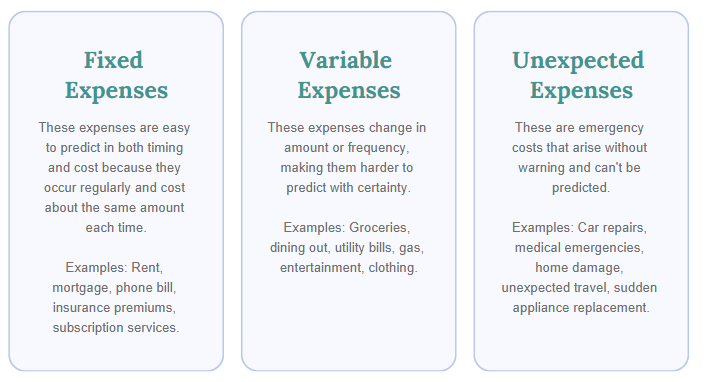

These are easy to predict in both timing and cost because they happen regularly and cost about the same amount each time.

How you’ll budget for these depends on the time period you’re budgeting around. Most bills and monthly paychecks happen on a monthly cycle, so most people prefer to set up their budget by the month.

Example: Weekly Meal Kits

I pay $60 for meal kits delivered every week. That means every month, I pay $240 for fresh, delicious food deliveries totally worth it.

For anything that occurs multiple times a month:

- Multiply the cost by how many times it occurs.

One tricky thing to keep in mind is that most months have more than four weeks. Well, except for February which has exactly four weeks, except in leap years.

Fun fact: I have a friend whose birthday is on February 29th. We joke that he’s 8 years old (really, he’s 34).

Why this matters for budgeting:

One month I might only pay four times, but another month might have five Mondays meaning an extra charge. To make it easy, treat every month as if it has 4.5 weeks.

For Expenses Less Frequent Than Monthly

If something happens less often, budget for it by splitting the cost between however many months the cycle lasts.

Example:

- My online gaming subscription renews every 3 months for $120.

- $120 ÷ 3 = $40 per month.

If I save $40 each month, I’ll have exactly what I need when renewal time comes.

Variable Expenses

Variable expenses are a little harder to account for. Their timing and cost vary each time, so you can’t accurately predict them.

Example: Groceries

Most of us don’t buy exactly the same items every time we shop. Prices fluctuate, and the timing between trips can change.

How to Predict Variable Costs:

One trick is to take the average of previous spending.

Example:

- Last few months: $380, $410, $320

- Add them: $1,110

- Divide by 3 = $370 average per month

If I budget $370 for groceries, the lower-spending months will balance out the higher ones.

Overestimating for Safety

Some people like to overestimate their budget for variable expenses.

For example, I usually pay $100 for my power bill, but I might budget $150 just to be safe. Any leftover money can go into savings or be spent elsewhere.

This is similar to a method called envelope budgeting which we’ll cover in another lesson.

Emergencies: The Most Variable Expense of All

Emergencies can happen anytime and they’re impossible to predict.

Example: A strong storm blows a branch through your fence. Suddenly, you have an expensive repair you never planned for.

You can’t plan for the unplannable. You’re not a psychic.

But you can prepare for it financially.

The key:

- Have a dedicated savings line in your budget.

- This is for the “you” of today to hide away for the “you” of tomorrow.

“Here you go, tomorrow Justin.”

“Oh sweet, a $20. Thanks, yesterday Justin!”

Recap

- Fixed expenses: Adjust the budgeted amount if needed so you can always pay them.

- Variable expenses: Use an average of past spending or budget extra to be safe.

- Emergencies: Always keep a dedicated savings line for unexpected costs.

If you’re ready, start working on your budget. Check your guided notes for helpful tips.

And remember if I don’t pay my power bill, I can’t make more videos to teach you about the 50-30-20 rule or envelope budgeting. So… I should probably do that. See you later!